Post-Brexit in 2021: Filing German Export Declarations

Learn how to file export declarations for shipments leaving Germany in this post-Brexit economy! For German exporters, shipping to the UK in 2021 post-Brexit negotiations is like shipping to non-European Union countries.

Are you short on time? Jump down to the bottom to optimize your German export declarations.

Because of the Brexit transition period, all export and customs regulations were not changed or affected until Dec. 31, 2020. The beginning of 2021 imposed new customs formalities for all EU nations, including Germany, to follow when trading with the UK.

With the UK being Germany’s fifth top trading partner, it’s crucial for German exporters to know what they need to do now that the Brexit transition is over.

How Does Brexit Affect German Exporters?

The quick answer is that all goods leaving and entering the UK from Germany are subject to the EU legislation's customs procedures beginning on Jan. 1, 2021.

There is a lot of information on Germany’s Brexit regulation via the German Customs Authority. We’re here to give you the core essentials, which will help you get started on your post-Brexit German customs declaration journey.

If you’ve been trading outside the EU before Brexit, then the process is the same as exporting to non-EU countries! However, if your company still plans to ship to the UK, then you must follow additional customs procedures.

Your first task should be to add the UK to your company’s existing authorizations, in terms of shipping, processing, and storage.

How can German Exporters Follow Post-Brexit Customs Compliance?

Do your shipments to the UK from Germany meet any of the following conditions?

- Goods valued more than 1,000 euros

- Goods weighing more than 1,000 kg

If your exports match one or both conditions above, you must file export declarations through a mandated e-customs system. The German Customs Authorities require all exports destined outside the EU to be filed through Automatisiertes Tarif-und Lokales Zollabwicklungssystem Zoll (ATLAS Zoll). Additionally, EU regulations apply for all means of transport you decide on.

Because the UK is now no longer part of the EU trade agreement, Germany must treat the UK like any other non-EU nation.

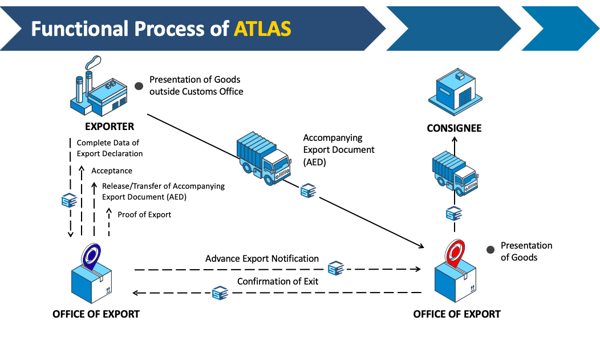

All carriers shipping out of Germany to the UK must carry the EU-mandated Accompanying Export Documents (AED), which can only be granted by German customs authorities. You must file your export declarations through ATLAS Zoll to retrieve the AED and other documents. ATLAS Zoll also serves as a communication system between your supply chain and the German customs office.

Here’s how filing an export declaration through ATLAS Zoll works:

The Exporting and Customs Clearance Process through ATLAS Zoll

- The shipper files the export declaration to German custom authorities through ATLAS Zoll

- The shipper can cancel declarations and/or send further export information on shipments

- German customs office approves and accepts the export declarations

- German customs office sends to the shipper relevant documents, including the AED

- The German shipper sends the AED and their shipments with the carrier for delivery

- The German shipper receives notifications on the arrival of their shipments at the exit customs office of export for presentation

Before you can file German export declarations through ATLAS Zoll, however, you must follow these steps:

- Register for the General Customs Directorate to participate in ATLAS Zoll

- Acquire a Participant Identification Number (BIN) to identify your company for exporting

- Acquire an EORI and Branch Number through the online customs portal

For more information, read our guide: Best Practices on How to Export from Germany.

Post-Brexit: Your Next Steps in German Export Declarations

The best practice for filing export declarations from Germany is to automate this process!

Especially for German exporters who run SAP as their enterprise resource planning software, ShipATLAS is the solution for you. ShipATLAS is the German export system software made to simplify your supply chain logistics for shipments made from Germany out of the EU. If you plan to ship to the UK, expedite the customs clearance process with ShipATLAS.

How Can ShipATLAS Optimize Your German Export Declarations?

- Integrates with Germany’s e-customs system ATLAS Zoll to streamline your export process

- Certified to process exit and entry messages directly in your ERP system

- Improve processing time by reading customs response and paperwork directing in SAP

- Maintain master data and code list to maximize efficiency

- Avoid costly legal penalties by following German federal customs compliance

Confidently export your German goods to the UK with ShipATLAS, the customs compliance software. Sign up for a free product demo of ShipERP’s Germany export declarations software now.