German Export Declaration Best Practices

Ensure federal compliance before you export goods from Germany with these best practices. Learn how you can seamlessly execute export filing through ATLAS, Germany's e-customs system.

Are you exporting goods outside of the European Union from Germany valued at more than 1,000 euros, or weighing more than 1,000 kg? Then your company must follow the procedure that sends export declarations to Germany's customs authorities!

Understand the customs process to seamlessly ensure your goods arrive at its destination. Before you can export, prepare your supply chain export process with the necessary information to correctly declare your exports.

Step 1: Gather all the required information for your export declaration documents.

Prevent customs delays by acquiring all relevant information to include in the export documents you need to submit to the German customs authorities.

Acquire a Value-Added Tax (VAT) identification number.

Germany requires different identification numbers for various tax purposes, including exports. To obtain a VAT number, as well as a tax number, you must apply to the local tax authority for approval which can take as long as four to six weeks. The application form includes documents that contain information about your business, evidence of the authority of the legal representative, and details about your planned activities. These numbers are associated with identifying your business in Germany and will be used to fill out other export documents and request forms.

Best Practice Tip: Ensure 100% documentation compliancy with a VAT application service.

Generally, most countries require you to submit the VAT-request application in their local language. If you’re not familiar with German, there are translation services like Marosa or Avalara to help your company complete the application process without language barriers.

Request an EORI and Branch Number.

It’s mandatory for any economic operator in Germany who participates in export shipping to have a unique Economic Operators' Registration and Identification (EORI) number. The EORI number is a prerequisite and must be included in every customs declaration for clearance to export out of the EU.

When you’re assigned an EORI number, you’ll also be assigned a branch number that will identify your company establishments as the headquarters (“0000”) and/or branches ("0001", "0002", "0003" ... through "9999"). The branch number enables separate child establishments (branches) to transmit messages (tax notices and approval decisions). With its own branch number, that establishment can continue to deal with the customs authorities on its own behalf.

For more information about the EORI and Branch Number, visit the German customs website.

Best Practice Tip: Apply for EORI and Branch Number at the online customs portal.

You can fill out Form 0870 which requires a legally binding signature and sent together with required documents by e-mail, letter, or fax. Avoid any complications by expediting the application process using the German Customs Portal. Simply verify your company data with customs authorities when you create an account, and you can apply for an EORI number and edit your EORI-relevant information at any time.

Other information you may need for customs declaration:

- Code number: An 11-digit code number used to identify specific goods and/or specific actions like authorization requests. It must be included in both paper-based and electronic customs declarations.

- Excise number: An identification number provided by the customs authorities which is an indicator that your business can participate in a tax suspension procedure.

- Tax number: You can obtain this information in the same application for the VAT identification number.

Step 2: Know how to ensure compliancy with Germany’s regulations on export filing.

There are rules and restrictions when it comes to exporting from Germany due to prior foreign policy and/or trade agreements. Prevent penalties by educating yourself and your team on what you can or cannot do.

- Keep in mind which countries you cannot export to

- Understand which category of goods is restricted or entirely prohibited

- Some individuals/institutions may be significantly restricted

Best Practice Tip: Automate a denied party screening to ensure compliancy with restrictions.

With many restrictions from various avenues, it can be difficult to keep up with what and where you can export to. Consider using screening solutions to check denied party listing in real-time at every export checkpoint. For example, U.S. exporters can use the SAP-integrated solution ShipDPS access MK Data Services for screenings.

Step 3: Begin your export process by declaring customs.

Documentation required to submit to Germany may vary depending on the destination country due to prior trade agreements and the specific goods you’re exporting. Customs declarations generally include information on the origin of the goods, the customs tariff, and customs value of the goods.

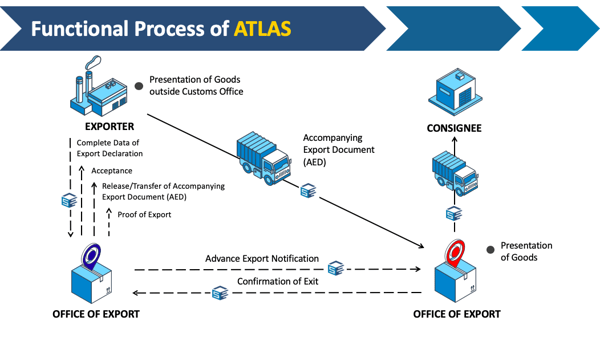

The German Customs Administration requires export declarations to be filed through the e-customs system called the Automatisiertes Tarif- und Lokales Zollabwicklungssystem (ATLAS). It’s an EU-wide obligation for shippers to participate in ATLAS electronic export for all modes of transport.

Companies execute export filing through ATLAS to be approved by customs authorities, then they’re able to retrieve the Accompanying Export Documents (AED/EAD) and other required documents.

- Register for the General Customs Directorate: In order to participate in ATLAS, you must apply to the German customs authorities with form 0874. You also must use an FTAM network connection to securely transmit messages between your company and customs.

- Obtain a Participant Identification Number (BIN): Submit form 0872 to acquire a unique BIN which customs authorities can identify your company for export authorizations.

- Execute export filing through ATLAS: After obtaining permission from Germany’s customs authorities, you’re ready to begin exporting out of the EU from Germany! Use all the information you’ve acquired, like the VAT and EORI number, to fill out declaration for export filings through ATLAS.

Best Practice Tip: Automate German export filing system through ATLAS directly in SAP with ShipATLAS.

ShipATLAS provides companies running SAP ERP the ability to automate export filing through ATLAS during the export process to simplify and increase the transparency of supply chain export logistics. The solution allows for:

- Certified processing of exit and entry messages

- Reading customs response and paperwork directly in SAP

- Master data and code list maintenance

- German federal customs compliance and integration

Step 4: Happy exporting!

With all the required information and knowledge on how to export out of the EU from Germany, you can kick start your exporting process with submitting your export filing through ATLAS. To make it all easier, consider automation to expedite the export process!